" Tax Cuts and Jobs Act: A Comparison for Large Businesses and International Taxpayers." Federal Corporate Income Tax Rates & Brackets 1909-2020." " Deducting losses in the CARES Act’s window." " H.R.1 - An Act to Provide for Reconciliation Pursuant to Titles II and V of the Concurrent Resolution on the Budget for Fiscal Year 2018." " International Comparisons of Corporate Income Tax Rates," PDF. With Its International Peers."Ĭongressional Budget Office.

" Publication 5318, Tax Reform - What's New for Your Business,".

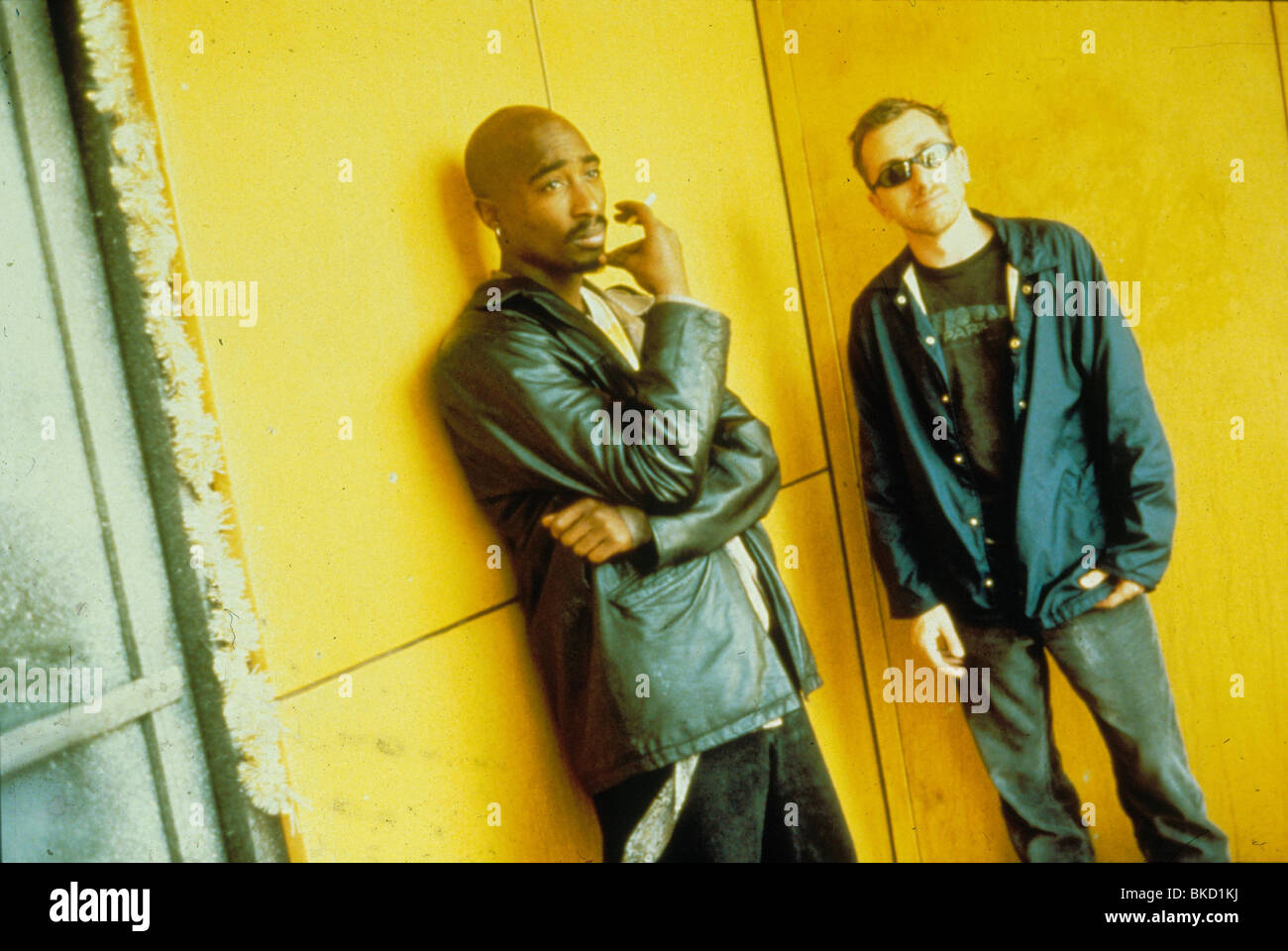

" How did the TCJA Change the Standard Deduction and Itemized Deductions?" " Effects of The Tax Cuts and Jobs Act: A Preliminary Analysis,". " H.R.1994 - Setting Every Community Up for Retirement Enhancement Act of 2019." " Retirement Topics - 401(k) and Profit-Sharing Plan Contribution Limits."Ĭ. " Miscellaneous Itemized Deductions: No Longer Deductible." " Publication 526, Charitable Contributions,". " Publication 5307, Tax Reform Basics for Individuals and Families,". " Publication 5307, Tax Reform Basics for Individuals and Families," Pages 5-6. " Families Facing Tax Increases Under Trump's Tax Plan," Pages 3-4. " Publication 5307, Tax Reform Basics for Individuals and Families," Pages 7-8. " It Matters How Tax Brackets are Adjusted." " Use an Alternative Measure of Inflation to Index Social Security and Other Mandatory Programs." " Congressional Record - Senate: Tax Cut and Jobs Act Continued," Pages 11-12.Ĭongressional Budget Office. " Bipartisan Health Care Stabilization Act of 2018." " Repealing the Individual Health Insurance Mandate: An Updated Estimate,". " Individual Shared Responsibility Provision."Ĭongressional Budget Office. " In 2018, Some Tax Benefits Increase Slightly Due to Inflation Adjustments, Others Unchanged (Archived Content)." " Be Tax Ready – Understanding Tax Reform Changes Affecting Individuals and Families." " Updated 2018 Withholding Tables Now Available Taxpayers Could See Paycheck Changes by February." " How Did the TCJA Affect the Federal Budget Outlook?" " H.R.1 - An Act To Provide for Reconciliation Pursuant to Titles II and V of the Concurrent Resolution on the Budget for Fiscal Year 2018: Summary." " How the 2017 Tax Act Affects CBO’s Projections." " Parliamentarian Determines Three Provisions in Republican Tax Bill Are Impermissible."Ĭongressional Budget Office. United States Senate Committee on the Budget. 1," Select Party, "Republican," and Select Vote, "Nay/No." " H.R.1 - An Act To Provide for Reconciliation Pursuant to Titles II and V of the Concurrent Resolution on the Budget for Fiscal Year 2018: Actions."Ĭlerk of the U.S. " H.R.1 - An Act To Provide for Reconciliation Pursuant to Titles II and V of the Concurrent Resolution on the Budget for Fiscal Year 2018." " H&R Block Data Shows Taxes Down 25 Percent Due to Tcja Impact." " Tax Cuts and Jobs Act: Assessment of Implementation Efforts,". Treasury Inspector General for Tax Administration. This soundtrack along with 3 others ( Above the Rim, Murder Was the Case & Gridlock'd) released on Death Row is packaged in a 4-disc set called The Death Row Archives. The soundtrack peaked at #2 on the Billboard 200 albums chart in the US behind The Velvet Rope by Janet Jackson, and was eventually certified 2× Platinum by the Recording Industry Association of America. The album features contributions by the likes of CJ Mac, J-Flexx, Tha Realest, members of Dogg Pound, Outlawz, Westside Connection, four songs by the supporting actor Tupac Shakur, and also marked the first national rap debut of Kansas City rapper Tech N9ne. Production was handled by several record producers, including Daz Dillinger, Quincy Jones III, Binky Mack and Bud'da among others. It was released on October 7, 1997, through Death Row Records, making it their first album to be distributed by Priority Records after Interscope Records dropped Death Row from their label. Gang Related – The Soundtrack is a soundtrack for the Jim Kouf's 1997 crime film Gang Related.

0 kommentar(er)

0 kommentar(er)